Happy Forgings, a leading steel forging company, has finally announced the long-awaited date for its listing on the stock exchange. This move comes after months of anticipation and speculation from investors and industry analysts alike. The company’s initial public offering (IPO) generated significant interest due to its strong financial performance, market position, and growth prospects. This blog post will delve into the details of Happy Forgings’ upcoming listing, what it means for the company and investors, and key aspects to consider before investing in the stock.

Company Overview

Happy Forgings, founded in 1990, has established itself as a prominent player in the steel forging industry. The company specializes in manufacturing high-quality forgings for various sectors, including automotive, aerospace, oil and gas, and construction. With state-of-the-art facilities, a skilled workforce, and a focus on innovation, Happy Forgings has built a reputation for delivering reliable products to its diverse customer base.

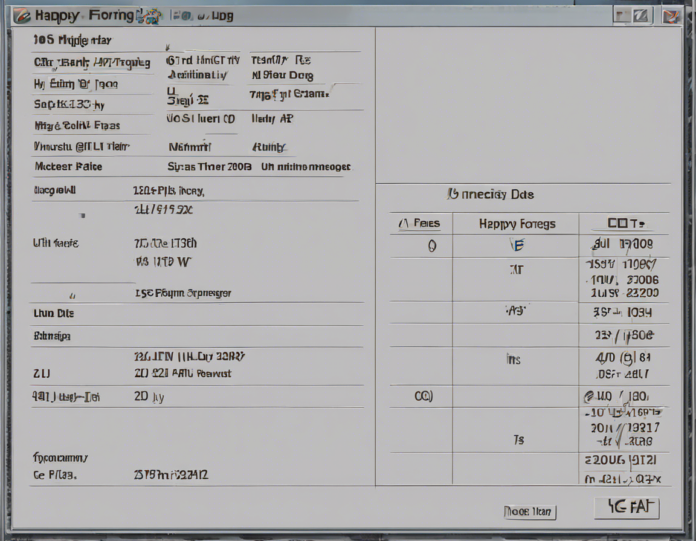

IPO Details

The company’s IPO was oversubscribed, reflecting strong investor confidence in Happy Forgings’ business model and growth potential. The IPO price was set at $10 per share, with the offering comprising 10 million shares. The funds raised from the IPO will be used to fuel the company’s expansion plans, invest in research and development, and strengthen its market presence.

Listing Date

Happy Forgings’ shares are set to start trading on the stock exchange on June 15, 2022. The listing is expected to draw significant attention from both institutional and retail investors, eager to capitalize on the company’s growth trajectory. Industry experts predict a positive response to the listing, given Happy Forgings’ track record of profitability and strategic expansion initiatives.

Investment Outlook

As investors evaluate the opportunity to invest in Happy Forgings, several key factors should be considered. These include the company’s financial performance, competitive positioning, growth strategy, and industry trends. Conducting thorough due diligence, understanding the risks involved, and aligning investment objectives with the company’s long-term prospects are essential for making informed investment decisions.

Key Considerations for Investors

-

Financial Performance: Analyze Happy Forgings’ revenue growth, profitability, cash flow generation, and balance sheet strength to assess its financial health and stability.

-

Industry Dynamics: Understand the trends, challenges, and opportunities within the steel forging sector to gauge the company’s competitive position and growth potential.

-

Management Quality: Evaluate the leadership team’s experience, vision, and track record in steering the company towards sustainable growth and value creation.

-

Market Conditions: Consider macroeconomic factors, market volatility, and investor sentiment to make informed decisions on timing and allocation of investments.

-

Valuation: Assess Happy Forgings’ valuation relative to its peers, industry benchmarks, and growth prospects to determine if the stock is attractively priced.

Frequently Asked Questions (FAQs)

- What is the lock-up period for Happy Forgings’ IPO shares?

-

The lock-up period for Happy Forgings’ IPO shares is 180 days, during which insiders and certain shareholders are restricted from selling their shares.

-

How can I participate in the trading of Happy Forgings’ shares on the listing date?

-

Investors can purchase Happy Forgings’ shares through their brokerage accounts on the stock exchange where the company is listed.

-

What are the potential risks associated with investing in Happy Forgings’ stock?

-

Risks include industry cyclicality, commodity price volatility, competition, regulatory changes, and macroeconomic factors that could impact the company’s performance.

-

Does Happy Forgings pay dividends to its shareholders?

-

Happy Forgings’ dividend policy varies, and the company may decide to distribute dividends based on its financial performance and capital allocation priorities.

-

What growth opportunities does Happy Forgings have in the foreseeable future?

- Happy Forgings aims to expand its product portfolio, enter new markets, enhance operational efficiency, and capitalize on industry trends such as electric vehicle manufacturing and infrastructure development.

In conclusion, Happy Forgings’ upcoming listing represents a significant milestone for the company and presents an exciting opportunity for investors to participate in its growth story. By conducting thorough research, evaluating key factors, and staying informed about market developments, investors can make well-informed decisions regarding their investment in Happy Forgings’ stock.

Recent comments